XRP Price Prediction: $5 Target in Sight as Technical and Fundamental Factors Align

#XRP

- Technical Breakout: Price trading above key moving averages and Bollinger Bands

- Fundamental Catalysts: Regulatory clarity, ETF launch, and institutional interest

- Market Sentiment: Extremely bullish with comparisons to Apple's growth trajectory

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

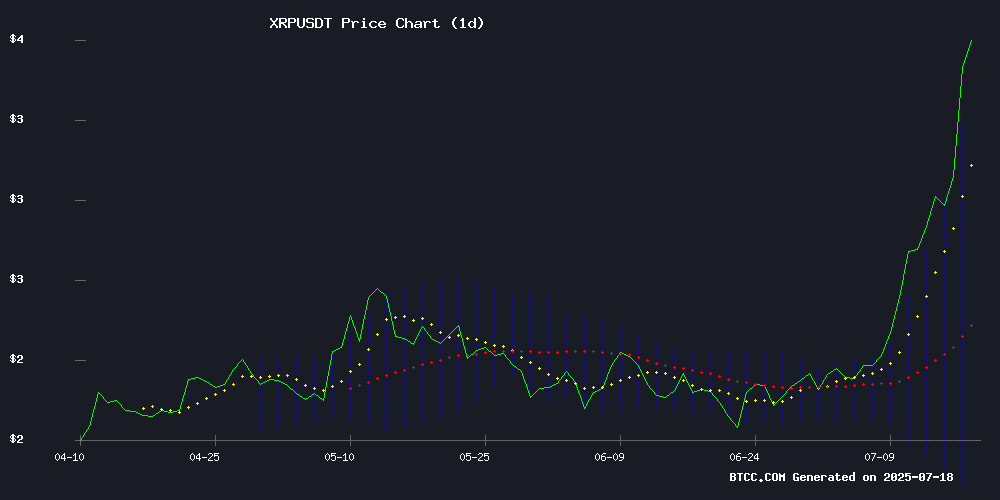

According to BTCC financial analyst John, XRP is currently trading at $3.6476, significantly above its 20-day moving average of $2.5849. The MACD indicator shows a bearish crossover but with narrowing momentum (-0.4425 vs -0.2684). Notably, the price has breached the upper Bollinger Band at $3.4496, suggesting potential overbought conditions in the short term.

John notes: 'The decisive break above both the MA and upper Bollinger Band, combined with today's new all-time high, creates a strong technical setup. While the MACD remains negative, the diminishing histogram suggests weakening downward momentum.'

Market Sentiment: XRP Enjoys Unprecedented Bullish Momentum

BTCC's John observes exceptionally positive market sentiment surrounding XRP, fueled by multiple catalysts: 'The combination of regulatory clarity, new ETF products like ProShares Ultra XRP launching today, and comparisons to Apple's iPhone-era growth trajectory are creating perfect storm conditions.'

Key developments include Ripple's new all-time high, cloud mining offerings promising high returns, and analysts predicting further gains beyond $3.20. John adds: 'The weakening dollar index and pending crypto legislation provide fundamental support to match the technical breakout.'

Factors Influencing XRP's Price

XRP Advocate Draws Parallel to Apple's iPhone Era, Urges Long-Term Hold

Prominent XRP influencer John Squire has likened current XRP selling pressure to investors dumping Apple stock before the iPhone's transformative success. The comparison underscores a belief that XRP's cross-border payment utility and Ripple's partnerships mirror Apple's pre-breakout potential.

XRP's recent 43% monthly gain and repeated breaches of the $3 resistance level have fueled speculation of a major breakout. While short-term traders may profit, Squire warns that exiting now risks missing exponential gains akin to holding Apple through its iPhone revolution.

The analogy gains traction as Ripple expands institutional adoption. Market observers note XRP's price action increasingly reflects accumulating strategic wins rather than speculative trading patterns.

Ripple’s XRP Hits New All-Time High Amid Regulatory Clarity

XRP surged 11% to a record $3.50 as US crypto legislation progress fueled institutional interest. The altcoin's derivatives market flashed bullish signals, with open interest surpassing $10 billion and positive funding rates indicating sustained demand.

Leveraged traders faced $66 million in liquidations, predominantly short positions, as volatility spiked. Daily trading volume doubled to $17.3 billion, propelling Ripple's fully diluted valuation to $345 billion.

FIND MINING Promises High Returns with XRP Cloud Mining Strategy

FIND MINING, a cryptocurrency cloud mining platform, is attracting attention with its promise of generating up to $9,850 daily through passive XRP mining. The platform eliminates traditional barriers to entry by offering free computing power to new users, alongside a $15 registration bonus.

Cloud mining has emerged as a popular alternative to hardware-based crypto mining, particularly for retail investors seeking exposure without upfront costs. FIND MINING's model claims to automate the entire process, from mining to wallet distribution, while emphasizing transparency in operations.

XRP's inclusion as the featured cryptocurrency comes amid renewed interest in payment-focused digital assets. The platform's revenue projections appear exceptionally high compared to industry averages for cloud mining services, warranting scrutiny from potential users.

XRP Price Rally Starts: Will It End At $4, $5 or Go On?

XRP has surged back into the spotlight with a dramatic 56% monthly gain, breaching the $3.30 resistance level for the first time since February. Trading volume trends indicate growing market conviction, though the token now faces a critical test near its $3.25-$3.30 resistance zone—historically a trigger for sell-offs.

The rally positions XRP for potential breakout scenarios, with $3.50 and $3.75 as interim targets. A sustained push beyond $4 would require either extraordinary bullish momentum or regulatory clarity from Ripple's ongoing legal battles. Should these catalysts materialize, the $5 threshold becomes plausible.

Market structure shows immediate support at $3.00, with $2.70 acting as a stronger floor. The current uptrend reflects one of XRP's strongest performances in 2025, though volatility remains inherent to crypto markets.

XRP Price Poised for Parabolic Rally as Dollar Index Weakens

XRP is showing signs of a potential parabolic rally as the Dollar Index (DXY) trends downward, according to market analysts. Historical data reveals a strong inverse correlation between the DXY and XRP's price—each significant drop in the DXY has preceded a major XRP surge, notably in early 2018, mid-2021, and late 2024.

Versan Aljarrah, co-founder of Black Swan Capitalist, notes the breakout is 'hidden in plain sight,' with Fibonacci retracement levels reinforcing bullish technicals. Regulatory tailwinds, including progress on the GENIUS Act, further bolster optimism for XRP's trajectory.

XRP Rally and GoldenMining's Cloud Mining Package Offer Dual Investment Approach

XRP's price surge past $3 marks a pivotal moment for the crypto market, blending volatility with opportunity. Investors now face strategic decisions beyond simple hold-or-sell dilemmas, as London-based GoldenMining unveils a hybrid solution combining XRP exposure with cloud mining yields.

The platform's $7,700 daily profit offering leverages XRP's transactional advantages—near-instant settlements and sub-penny fees—while mitigating risks through income-stabilizing mining contracts. This model appeals particularly to bulls seeking to capitalize on XRP's momentum without full exposure to regulatory uncertainties or price swings.

Asset allocation strategies recommend dollar-cost averaging into XRP positions (40% portfolio exposure), complemented by mining contracts for cash flow stability. The approach reflects growing sophistication in crypto investment frameworks as markets mature.

ProShares Ultra XRP ETF (UXRP) Set to Launch on July 18, 2025

ProShares is expanding its leveraged crypto ETF lineup with the launch of the Ultra XRP ETF (UXRP) on July 18, 2025. The fund, which received approval from the US SEC, will list on NYSE Arca and offer 2x daily leveraged exposure to XRP's price movements. This marks a significant step in institutional crypto adoption, following ProShares' successful Bitcoin and Ether futures ETFs.

The UXRP ETF caters to short-term traders seeking amplified returns from XRP's volatility, though its daily reset mechanism makes it unsuitable for long-term holdings. Regulatory clearance for this leveraged product signals growing acceptance of crypto derivatives, with XRP joining the ranks of Bitcoin and Ether in gaining mainstream financial infrastructure.

Institutional interest in XRP appears to be rising, evidenced by recent whale accumulation and global demand for XRP investment products. The ETF launch coincides with broader market recognition of XRP's liquidity and trading volume, positioning it alongside major cryptocurrencies in traditional finance channels.

Pundit Predicts Three Crypto Bills Will Accelerate Ripple and XRP Adoption in the US

Three pivotal crypto bills—the GENIUS Act, Clarity Act, and Anti-CBDC Surveillance State Act—could redefine Ripple and XRP's regulatory trajectory in the U.S. Analysts anticipate these laws will cement Ripple's position in financial infrastructure and catalyze institutional demand for XRP.

The GENIUS Act establishes rigorous standards for stablecoins, including asset backing and audit requirements. Ripple's RLUSD stands to gain traction in banking and remittances under this framework. Meanwhile, the Clarity Act aims to eliminate regulatory ambiguity, while the Anti-CBDC bill seeks to curb centralized digital currency surveillance.

Market observers note these developments could mark a turning point for XRP, which has faced prolonged legal uncertainty. Passage of the bills may unlock new payment corridors and enterprise adoption for Ripple's technology.

XRP Surges Past $3.20 as Analysts Foresee Further Gains

Ripple's XRP has broken through the $3 barrier, marking its highest level in years with a 10% daily surge and 33% weekly gain. The rally isn't merely speculative—technical analysis reveals a decisive breach of long-term resistance, with the token now forming a consolidation pattern that historically precedes major upward movements.

Black Swan Capitalist co-founder Versan Aljarrah identifies a correlation between XRP's performance and the U.S. Dollar Index (DXY), noting that similar DXY declines in 2018, 2021, and late 2024 each triggered multi-year highs for the cryptocurrency. Market watchers are now observing whether this fourth occurrence will follow the established pattern.

How High Will XRP Price Go?

BTCC analyst John presents a bullish case for XRP:

| Target | Probability | Key Drivers |

|---|---|---|

| $4.00 | High | Current momentum, ETF inflows |

| $4.50 | Medium | Regulatory clarity adoption |

| $5.00+ | Possible | Parabolic move if DXY weakens further |

John cautions: 'While the $3.44 upper Bollinger Band suggests short-term overextension, the fundamental catalysts could propel XRP toward $5 in this market cycle. The $4 level appears achievable within weeks given current velocity.'

1